As markets unravelled, there were few places for investors to hide. As coronavirus spread and war persisted in Ukraine, equity markets sold off indiscriminately, causing many panicked investors to sell riskier assets in exchange for cash.

During times of crisis, many investors who’ve worked their whole lives saving for retirement start thinking about what happened during past recessions. Memories of these prior events, coupled with the barrage of frightening headlines from media outlets, can make it tough to maintain a planned asset mix and stay invested amid a market correction.

Sometimes emotions can lead investors down financial paths that feel right during anxious moments, but may not be best for their long-term goals. When you make an investing plan that factors in normal market ups and downs, you can feel confident, even during market volatility, that your portfolio is doing exactly what it was built to do.

Because anxious moments are just that, moments. They pass. And when they do, your investing plan will still be there, zen as ever, always working toward the goals you set.

But are investors well-served by abandoning their long-term allocations to move to the safety—but limited return potential—of cash?

It’s true that with the turmoil sell-off still in its infant stages, the future is yet to be fully seen. However, it’s fair to say that moving to cash at this year’s market bottom and forgoing a return from equities is likely to have been a costly mistake for many investors.

We all know the market goes up and down each day, although wild swings can make even the most collected investor second-guess their strategy. Sometimes swings are much more volatile than usual meaning that checking your investment account daily can create unnecessary stress and perhaps worse, major investment setbacks in trying to time the market.

Bank of America Vice Chairman, Keith Banks said “I think a lot of people are trying to get clever and time the market. The reality is, it’s time in the market, not timing the market.”

Another way to look at this is to consider that your home is an investment—even though it’s often not viewed as one in the same manner that your retirement is. Like the equity market, the housing market also sees frequent swings in value. But do you check the value of your home each and every day? If you’re not planning to sell soon, you likely don’t.

We believe the same logic should hold true for your other investments as well. If you have a long-term time horizon and an investment plan in place but find yourself tempted to stray from that plan amid the current crisis, it may make sense to discuss further with a financial professional—in order to fully understand the impacts of trying to time the market.

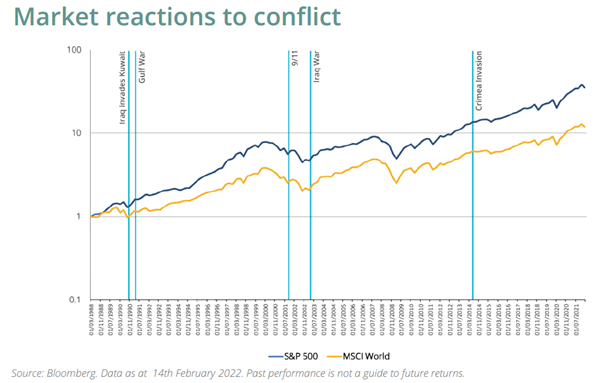

Ultimately, staying invested may pay off, even in times of crisis. As an example, take a look at the graph below that shows market reactions to previous global conflicts.

In anxious moments, it’s more important than ever to stay focused on your long-term goals. Remember, your investing plan doesn’t get stressed out by market volatility. It was built with bear markets in mind. Focus on the things you can control in your financial life, like maintaining a balanced portfolio, keeping your investing costs low, and saving more.

PLEASE NOTE: The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy.