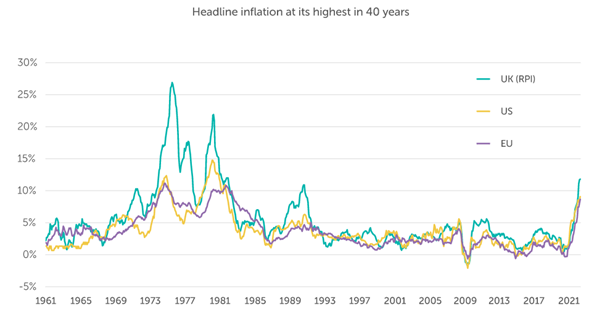

In May 2022 UK inflation reached its highest level in 40 years. Inflation has risen almost every month since August 2020 and this is not going away imminently, with the Bank of England forecasting that CPI inflation will rise to 11% by October 2022.

The same story is true across much of the developed world. It is not a coincidence that inflation started rising when lockdowns began to be lifted. The pandemic caused huge disruption to supply chains and labour shortages which, when combined with demand stimulus from central banks and governments, pushed inflation higher as lockdowns eased and consumer demand returned.

These factors should have eased over the course of 2022 as the economy reopened and stimulus faded. Sadly, inflation took a sudden turn for the worse following the Russian invasion of Ukraine in February 2022, largely due to the impact on energy prices.

For many investors this will be their first experience of such high inflation. For others it may bring back memories of the 1970s. Whatever their experience, investors are concerned about how the future path of inflation will impact their portfolios.

In this blog we outline why this is not a repeat of the 1970s, how we think the situation is likely to progress over the coming months and what that means for investment portfolios.

There is a reason investors are having flashbacks of the 1970s. The last time inflation rose as far and as fast as it has this year was in 1973, when a sharp rise in energy prices marked the beginning of a decade of inflation that rarely fell below 10%. However, markets do not expect a repeat of the 1970s. Instead, they expect inflation to fall below 2% by the middle of 2024 and we believe that this is with good reason.

There are a few key differences between the economy of today and the economy of the 1970s that lead us to expect that current inflation will follow a different path.

The most obvious difference is the size of the oil price rise. Oil prices rose tenfold during the 1970s, whereas in 2022 we’ve seen a 29% increase to a price that sits below the average price per barrel from 2011-2014.

However, the key difference lies in labour markets. In the 1970s inflation became entrenched through a self-reinforcing “wage-price spiral” in which higher costs led to higher wage demands, which resulted in rising costs. Since then, labour markets have experienced several structural changes that make a wage-price spiral much less likely. These include the changes below.

- Labour markets are less well organised. In 1973, 45.5% of the UK labour force was unionised. In 2018, it had fallen to 23.4%.

- The public sector is a much smaller proportion of the economy. In 1973, 25.8% of the workforce was employed in the public sector, including powerful nationalised industries such as coal mining. By 2018, only 16.5% was.

- UK workers face increased wage competition from abroad. In 1973, UK imports were 14% of GDP. By 2018, this number had risen above 30%.

This resulted in annual wage growth above 35% in the early 70s and only small falls in real wages. In 2022, while wage growth remains slightly stronger than in the last decade (4.3% in May), real wages are already falling and are expected to fall further.

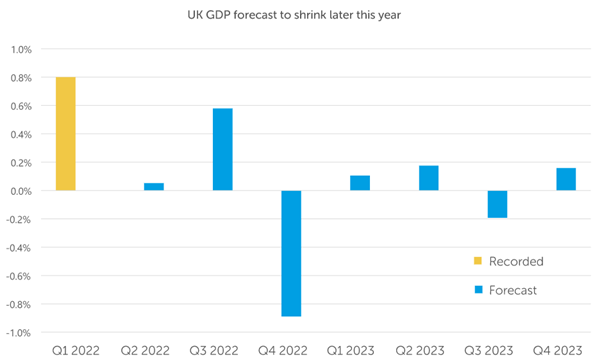

Regardless of the eventual outcome, we expect volatility to remain highly elevated in the coming months, with many of the major asset classes suffering losses. However, if inflation is brought under control then our medium-term outlook is more positive. As with many investment decisions, the right course of action will depend on your time horizon and your ability to weather the storm.

We believe, with a recession on the horizon, trustees should take action to consider how they can lock in the recent funding improvements by reducing risk within portfolios.

PLEASE NOTE: The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy.